글로벌 전기차 배터리 시장에서의 중국

2020년 2월 28일

글로벌 전기차 배터리 시장의 중국

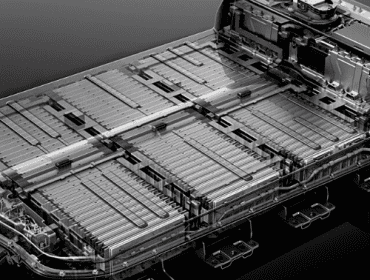

중국은 2019년에 전 세계 전기 자동차용 리튬 이온 배터리 제조의 108GWh 중 58%를 생산하는 양 측면에서 EV 배터리의 현재 시장 리더입니다.

2019년에 판매된 220만대의 전기차 중 중국이 115만대를 판매했다.

이는 전기차 판매량의 50% 이상이다. 0.2백만 CV는 중국 OEM에 의해 판매되었습니다. 최근 분석에 따르면 자동차 제조사들은 향후 5~10년 동안 중국에서 전기차와 전기차 배터리 개발을 위해 1350억 달러를 투자하고 있다.

정보 그래픽: 글로벌 EV 판매 분포

추진력

주요 추진력은 ICE와 비슷한 가격을 제공하는 보조금입니다. 주행거리가 250km 미만인 자동차에 대한 보조금이 사라지고 나머지 보조금이 50% 삭감된다는 점을 주목하는 것도 흥미롭다. 정부는 2020년에 보조금 측면에서 큰 변화가 없을지라도 향후 몇 년 동안 보조금을 단계적으로 폐지할 것으로 보입니다.

정보 그래픽: 차량 유형에 따른 공급업체 분포

중국 정부는 이제 국내 기업이든 외국 기업이든 중국에서 판매하는 모든 자동차 제조업체가 복잡한 크레딧 공식을 통해 판매 금액의 일정 비율을 전기차로 만들도록 요구하고 있습니다.

주요 선수

정보 그래픽: 중국 EV 배터리 공급업체 점유율

정보 그래픽: GWh 기준 2019년 상위 5개 제조업체

중국 시장에는 국내외 많은 제조업체가 있습니다. CATL, BYD 및 Guoxuan은 중국 OEM에 공급하는 주요 내부 제조업체입니다. 파나소닉, LG화학, 삼성SDI는 중국에 공장을 두고 있으며 권장 배터리 목록이 없어져 중국 및 비중국 OEM 모두에 공급할 수 있다.

CATL, BYD와 같은 중국 제조업체는 전 세계에 공장을 설립하고 Volvo, Tesla 등과 같은 다양한 OEM을 위한 셀/배터리 팩 공급도 착수하고 있습니다.

중국 비중국 OEM 및 중국 배터리 시장에 미치는 영향

정보 그래픽: 승용차 판매에서 PHEV와 BEV의 분할

중국 시장은 2018년 한 해에만 2,880만 대가 팔린 세계 최대 자동차 시장이다. 주요 OEM은 중국에서만 많은 수익을 창출합니다. 예를 들어 Volkswagen은 생산량의 약 40%를 중국에서 판매합니다. 시장 규모로 인해 글로벌 OEM이 중국 회사와 여러 합작 투자를 통해 중국에서 제조 및 판매하고 수출 목적으로 사용하게 되었습니다. OEM이 미래의 EV 플랫폼을 고려함에 따라 특히 중국 제조 공장의 배터리 공급은 중국 배터리 제조업체가 관리하게 될 것으로 보입니다. 배터리 공급을 위한 스마트 물류는 자동차 공장 인근에 배터리 공장을 세우는 것으로 파나소닉, LG화학, 삼성SDI가 중국에 공장을 세우고 있다.

정보 그래픽: 표: 중국에서 자동차 배터리용으로 예정된 몇 안 되는 공장

보조금 삭감 후 중국 전기차의 미래와 중국 배터리 시장에 미치는 영향

인기 있는 OEM은 이미 중국에 공장을 세웠고 Tesla는 상하이에 공장을 새로 추가했습니다. 정부 보조금은 고객이 EV를 탐색하도록 하는 데 도움이 되었지만 보조금 이후의 매력, 지원 인프라 및 EV가 제공하는 가격 대비 가치는 고객을 끌어들이는 매력적인 요소가 될 것입니다. 또한 배터리 가격의 글로벌 하락이 전체 EV 가격 하락에 도움이 된다는 사실은 OEM에 도움이 됩니다. 이는 주로 낮은 운영 비용 및 유지 관리로 인해 대중의 경향이 EV로 이동할 수 있기 때문에 배터리 공급업체에 이익이 될 것입니다.

지금 무엇을?

보조금 축소 이후 전기차 판매가 감소하고 있지만 시장은 전기차로 시선을 돌리고 있고 OEM도 관심을 갖고 있다. 배터리 제조업체는 생산량을 늘리고 공급망의 효율성을 개선하며 에너지 밀도, 안전성 및 비용 측면에서 배터리를 개선하고 있습니다. 중국의 주요 도시에는 EV 지원 인프라가 증가하고 있으며 중국 배터리 제조업체들도 BYD가 이미 배터리 재활용 공장을 열면서 배터리 재활용/재이용을 검토하고 있습니다. 미래는 균형의 EV 측면을 선호하는 경향이 있으며 배터리 제조업체는 지역 및 글로벌 수요를 따라잡아야 합니다.

정보는 "글로벌 전기 자동차 배터리 시장 2019-2025"라는 제목의 보고서에서 제공되었습니다. 무료 샘플을 다운로드하여 자세히 알아보기

China in Global Electric Vehicle Battery Market

China is the current market leader for EV batteries in terms of volume with China producing 58% out of 108 GWh of the global lithium ion battery manufacturing for electric vehicles in 2019.

Out of the 2.2 million electric cars sold in 2019, China was responsible for 1.15 million of them.

That’s more than 50% of the electric car sales. 0.2 million CVs were sold by the Chinese OEMs. According to a recent analysis, automakers are investing $135 billion to develop EVs and EV batteries in China over the next 5 to 10 years.

Driving Force

The Chinese government now requires all automakers who sell in China, whether domestic or foreign firms, to make a certain percentage of their sales electric, through a complex crediting formula.

Major Players

The Chinese market has many manufacturers both internal and external. CATL, BYD, and Guoxuan are the main internal manufacturers who supply to the Chinese OEMs. Panasonic, LG Chem, and Samsung SDI have plants in China and can supply to both Chinese and non-Chinese OEMs as the recommended battery list has been scrapped.

The Chinese manufacturers such as CATL, BYD are setting up plants throughout the globe and also establishing undertaking cell/battery pack supply for various OEMs like Volvo, Tesla, etc.

Non-Chinese OEMs in China and effect on the Chinese battery market

The Chinese market is the largest automobile market in the World in terms of volume as it sold 28.8 million units in 2018 alone. Major OEMs generate a lot of their revenue from China alone, for example, Volkswagen sells about 40% of its output in China. The size of the market has led to multiple joint ventures by global OEMs with Chinese companies to manufacture and sell in China and also for export purposes. As OEMs look into EV platforms for the future, the battery supply, especially in the Chinese manufacturing plants, looks like it’ll be managed by Chinese battery manufacturers. The smart logistics for battery supply is to set up a battery plant near the automobile plant and for this reason, Panasonic, LG Chem, Samsung SDI are setting up plants in China.

Future of EVs in China post-subsidy cuts and its effect on the Chinese battery market

Popular OEMs have already set up plants in China and Tesla is a new addition to this with its factory in Shangai. The government subsidies helped in drawing customers to explore EVs but post-subsidy appeal, supporting infrastructure and value for money offered by the EVs will be the alluring factor to draw customers. It also helps OEMs that the global decrease in battery pricing also helps in the overall EV price decrease which means that soon Electric and ICE vehicles will be of comparable pricing. This will be a boon for battery suppliers as the public tendency can shift towards EV primarily due to lower running costs and maintenance.

What NOW?

Though there is a decline in EV sales post-subsidy reduction, the market looks towards EVs so does the focus of OEMs. Battery manufacturers are increasing the volume of production, improving the efficiency of their supply chains and also improving batteries in terms of energy density, safety, and cost aspects. Major Chinese cities have a growing EV supporting infrastructure and the Chinese battery manufacturers are also looking into battery recycling/reusing with BYD already opening a battery recycling plant. The future tends to favour the EV side of the balance and the battery manufacturers will need to keep up with the demand both local and global.

The information has been sourced from our report titled “Global Electric Vehicle Battery Market 2019-2025”. Download free sample to know more